Manufacturing Industry News |

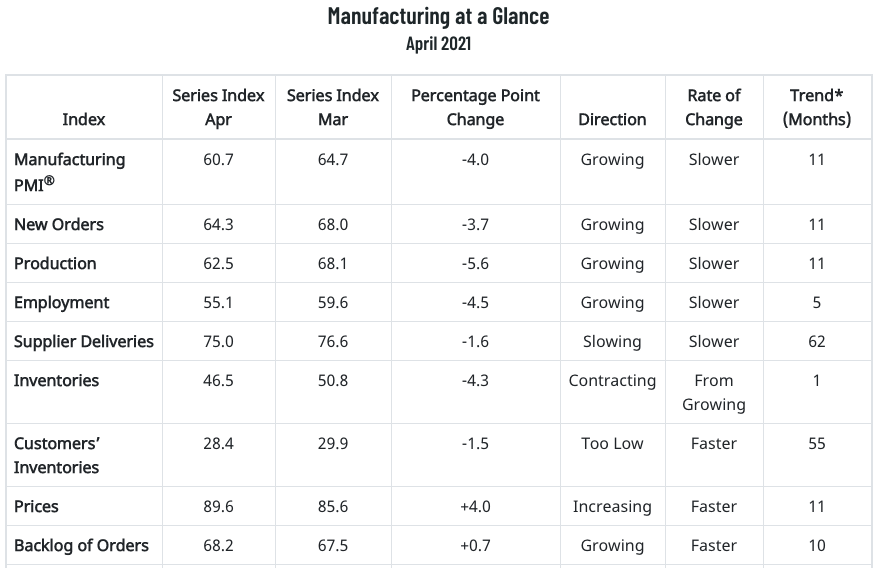

(Tempe, Arizona) — Economic activity in the manufacturing sector grew in April, with the overall economy notching an 11th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®. The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The April Manufacturing PMI® registered 60.7 percent, a decrease of 4 percentage points from the March reading of 64.7 percent. This figure indicates expansion in the overall economy for the 11th month in a row after contraction in April 2020. The New Orders Index registered 64.3 percent, declining 3.7 percentage points from the March reading of 68 percent. The Production Index registered 62.5 percent, a decrease of 5.6 percentage points compared to the March reading of 68.1 percent. The Backlog of Orders Index registered 68.2 percent, 0.7 percentage point higher compared to the March reading of 67.5 percent. The Employment Index registered 55.1 percent, 4.5 percentage points lower than the March reading of 59.6 percent. The Supplier Deliveries Index registered 75 percent, down 1.6 percentage points from the March figure of 76.6 percent. The Inventories Index registered 46.5 percent, 4.3 percentage points lower than the March reading of 50.8 percent. The Prices Index registered 89.6 percent, up 4 percentage points compared to the March reading of 85.6 percent. The New Export Orders Index registered 54.9 percent, an increase of 0.4 percentage point compared to the March reading of 54.5 percent. The Imports Index registered 52.2 percent, a 4.5-percentage point decrease from the March reading of 56.7 percent.” Fiore continues, “The manufacturing economy continued expansion in April. Survey Committee Members reported that their companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus (COVID-19) impacts limiting availability of parts and materials. Recent record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy. Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential. Optimistic panel sentiment increased, with 11 positive comments for every cautious comment, compared to an 8-to-1 ratio in March. Demand expanded, with the (1) New Orders Index growing at a strong level, supported by the New Export Orders Index continuing to expand, (2) Customers’ Inventories Index hitting another all-time low and (3) Backlog of Orders Index continuing at a record-high level. Consumption (measured by the Production and Employment indexes) indicated some cooling, posting a combined 10.1-percentage point decrease to the Manufacturing PMI® calculation. All top six industries reported moderate to strong consumption expansion. The Employment Index expanded for the fifth straight month, but panelists continue to note significant difficulties in attracting and retaining labor at their companies’ and suppliers’ facilities. Inputs — expressed as supplier deliveries, inventories, and imports — continued to support input-driven constraints to production expansion, at lower rates compared to March, due to an undesired inventory draw down. Inputs negatively contributed to the PMI® calculation, by a combined 5.9 percentage points. The importation of items marginally slowed in the period, driven by port backlogs. The Prices Index expanded for the 11th consecutive month, indicating continued supplier pricing power and scarcity of supply chain goods. “All of the six biggest manufacturing industries — Fabricated Metal Products; Chemical Products; Food, Beverage & Tobacco Products; Computer & Electronic Products; Transportation Equipment; and Petroleum & Coal Products, in that order — registered moderate to strong growth in April. “Manufacturing performed well for the 11th straight month, with demand, consumption and inputs registering strong growth compared to March. Labor-market difficulties at panelists’ companies and their suppliers persist. End-user lead times (for refilling customers’ inventories) are extending. This is due to very high demand and output restrictions, as supply chains continue to respond to strong demand amid COVID-19 impacts,” says Fiore. All 18 manufacturing industries reported growth in April, in the following order: Electrical Equipment, Appliances & Components; Textile Mills; Furniture & Related Products; Machinery; Fabricated Metal Products; Primary Metals; Miscellaneous Manufacturing; Chemical Products; Plastics & Rubber Products; Food, Beverage & Tobacco Products; Computer & Electronic Products; Nonmetallic Mineral Products; Apparel, Leather & Allied Products; Transportation Equipment; Paper Products; Petroleum & Coal Products; Printing & Related Support Activities; and Wood Products. WHAT RESPONDENTS ARE SAYING

More HERE

2 Comments

Reply

I would like to thank you for the efforts you have made in writing this post. I wanted to thank you for this website! Thanks for sharing. Great websites! I can also refer you to one of the best Manufacturing Analytics Services.

Reply

Leave a Reply. |

AuthorManufacturing industry news is provided by the Technology & Manufacturing Association in Schaumburg, IL Archives

June 2024

Categories |

RSS Feed

RSS Feed